Why Dubai Appeals to NRI Investors

Dubai’s real estate market continues to draw Non-Resident Indians (NRIs) due to its unique financial advantages. The absence of property taxes and capital gains taxes ensures higher returns compared to markets like India.

The city’s cutting-edge infrastructure, including world-class transport and amenities, enhances its appeal. Dubai’s vibrant expatriate community also creates a welcoming environment for NRIs.

Investor-friendly policies, such as long-term residence visas, provide added security. Annual rental yields, typically ranging from 5% to 8%, make Dubai a lucrative choice for portfolio diversification.

Understanding Dubai’s Property Market Dynamics

Dubai’s real estate market is globally recognized for its innovation and growth. Strategic urban planning has transformed areas like Downtown Dubai and Palm Jumeirah into premium investment hubs.

Emerging neighborhoods, such as Jumeirah Village Circle (JVC) and Dubai Silicon Oasis, offer affordable entry points with strong rental demand. The market’s resilience, even amidst global economic shifts, underscores its stability.

NRIs benefit from a transparent regulatory system managed by the Dubai Land Department (DLD), ensuring secure transactions and clear ownership rights.

Key Factors Driving NRI Investments

The zero-tax policy significantly boosts profitability. Unlike India, where property taxes can erode gains, Dubai allows investors to retain more income.

Long-term visas tied to property investments provide NRIs with a foothold in the UAE. These visas, available for properties valued at AED 750,000 or more, offer residency for up to three years.

High rental yields attract income-focused investors. Locations like Dubai Marina and Business Bay consistently deliver strong returns due to tenant demand.

Legal Framework for NRI Property Ownership

NRIs can purchase properties in Dubai’s freehold zones, which allow full ownership without restrictions. These zones include prime areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah.

The Dubai Land Department (DLD) oversees property transactions, ensuring transparency. Registration fees, typically 4% of the property value, apply to all purchases.

For off-plan properties, NRIs must conduct thorough due diligence. Financial advisors assist with verifying developer credibility and navigating documentation to avoid legal pitfalls.

Freehold vs. Leasehold Properties

Freehold properties grant complete ownership, allowing NRIs to sell, rent, or bequeath assets freely. Leasehold properties, less common, involve long-term leases but limit ownership rights.

Most NRIs prefer freehold properties for their flexibility and repatriation benefits. The DLD’s clear guidelines ensure foreign investors face no ownership restrictions in designated areas.

Choosing the Right Property Type

Dubai offers diverse property options tailored to different investment goals. Luxury apartments in Downtown Dubai appeal to those seeking capital appreciation.

Waterfront villas in Palm Jumeirah combine lifestyle benefits with high resale potential. For rental income, affordable units in JVC or Dubai Silicon Oasis offer strong yields.

Real Estate Investment Trusts (REITs) listed on the Dubai Financial Market provide an alternative for NRIs avoiding direct ownership complexities.

Top Investment Locations

Downtown Dubai remains a premium choice due to its proximity to landmarks like Burj Khalifa. Properties here often yield high capital gains.

Dubai Marina attracts expatriate tenants, ensuring consistent rental income. Emerging areas like JVC offer lower entry costs with growing demand.

Palm Jumeirah’s luxury villas cater to high-net-worth investors, blending investment returns with vacation home potential.

Financing Options for NRIs

NRIs can access home loans from UAE banks, dispelling the myth of mandatory cash payments. Loan-to-value (LTV) ratios typically range from 50% to 75%, depending on the property and applicant’s financial profile.

Banks like Emirates NBD and Mashreq offer competitive mortgage rates for NRIs. Financial advisors help compare loan terms to align with investment goals.

Using Non-Resident External (NRE) or Foreign Currency Non-Resident (FCNR) accounts simplifies fund transfers and ensures compliance with Indian regulations.

Mortgage Eligibility Criteria

UAE banks require NRIs to provide income proof, credit history, and valid identification. Minimum income thresholds vary but typically start at AED 15,000 monthly.

Loan tenures range from 5 to 25 years, with interest rates influenced by global and local market conditions. Advisors ensure NRIs select cost-effective financing options.

Taxation and Fund Repatriation

Dubai imposes no taxes on rental income or capital gains, maximizing returns. However, NRIs must declare Dubai property income in India under the Income Tax Act.

The Double Taxation Avoidance Agreement (DTAA) between India and the UAE helps minimize tax liabilities. Proper documentation ensures compliance with both jurisdictions.

Funds can be repatriated through NRE/FCNR accounts, adhering to India’s Foreign Exchange Management Act (FEMA) guidelines.

Managing Tax Compliance

NRIs should consult tax professionals to navigate Indian tax obligations. Maintaining clear records of rental income and capital gains is essential.

Financial advisors often collaborate with tax consultants to streamline repatriation processes, ensuring minimal tax impact and full regulatory compliance.

Risks and Mitigation Strategies

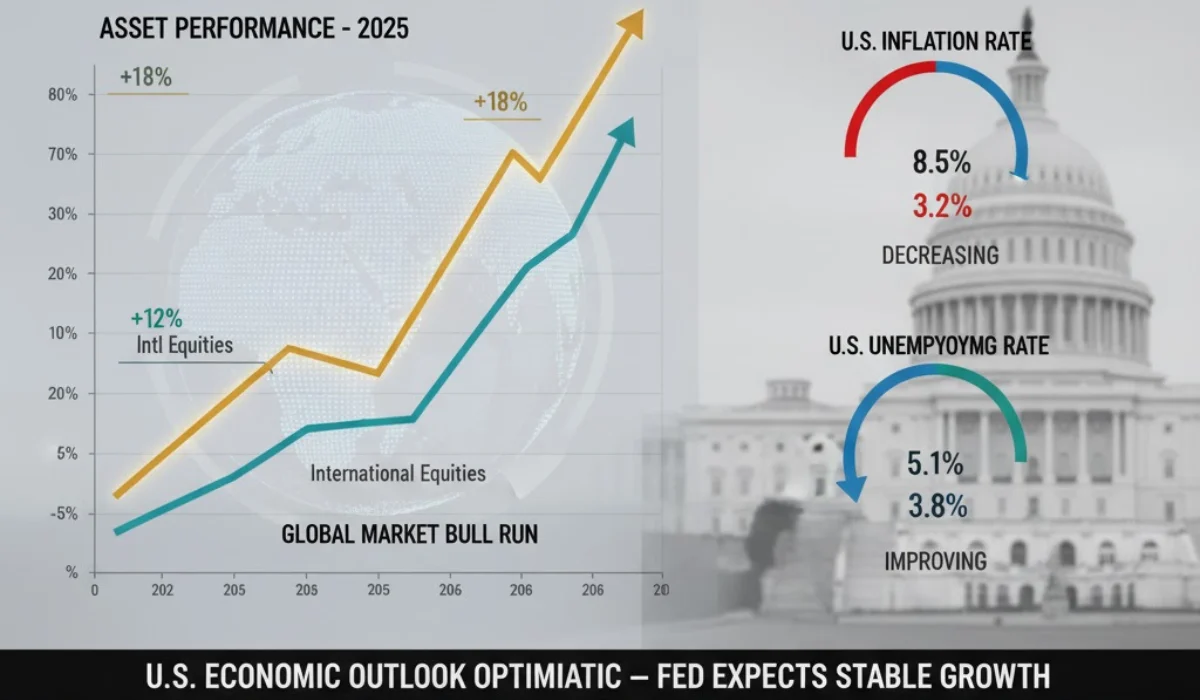

Real estate investments carry inherent risks, including market fluctuations and currency exchange volatility. NRIs must monitor global economic trends impacting Dubai’s property market.

Legal risks, such as incomplete documentation, can be mitigated by working with reputable advisors and developers. Regulatory changes in the UAE or India may also affect investments.

Diversifying across property types and locations reduces risk exposure. REITs offer a low-risk entry point for cautious investors.

Benefits of Working with Financial Advisors

Financial advisors provide critical expertise in navigating Dubai’s real estate market. They assist with property selection, legal compliance, and financing options.

Advisors conduct risk-return analyses to align investments with NRI goals. Their local knowledge ensures informed decision-making and long-term profitability.

Collaboration with tax consultants and legal experts further enhances investment security and compliance.

Conclusion

Dubai’s real estate market offers NRIs a compelling blend of tax-free returns, modern infrastructure, and investor-friendly policies. By understanding legal frameworks, selecting strategic properties, and leveraging financing options, NRIs can maximize returns.

Working with financial advisors ensures informed decisions and compliance with regulations in both Dubai and India. With careful planning, Dubai remains a top destination for NRI property investments.

Disclaimer : This information is for educational purposes only and does not constitute financial, legal, or tax advice. Consult qualified professionals before making investment decisions. No liability is accepted for errors, omissions, or losses arising from this content.

FAQs

Can NRIs purchase property in Dubai?

Yes, NRIs can buy properties in designated freehold zones with full ownership rights.

Is rental income from Dubai taxable in India?

Yes, it must be declared in India and is taxable unless covered by DTAA provisions.

Can NRIs secure loans for Dubai properties?

Yes, UAE banks offer mortgages to NRIs meeting income and credit criteria.

What are typical Dubai property returns?

Rental yields range from 5% to 8% annually, varying by location and property type.

Are there property taxes in Dubai?

No, Dubai has no annual property tax or capital gains tax.

What risks should NRIs consider?

Market fluctuations, currency risks, legal issues, and regulatory changes are key concerns.

Can NRIs jointly own Dubai properties?

Yes, joint ownership is allowed under UAE property laws.

How can funds be repatriated to India?

Through NRE/FCNR accounts, following FEMA guidelines.

What’s the minimum investment for a residence visa?

Properties worth AED 750,000 or more may qualify for a 3-year residency visa.

Can Dubai properties serve as vacation homes?

Yes, many NRIs use properties for both investment and personal use.