Bitcoin Rally and Market Momentum

Bitcoin's ascent to $125,000 on October 6, 2025, marked a pivotal moment for the cryptocurrency sector. This all-time high propelled the overall market capitalization beyond $4.38 trillion, reflecting a robust 12% increase over the past month.

Such gains align with seasonal patterns, often referred to as "Uptober," where historical data shows positive performance in October for major cryptocurrencies. The U.S. government shutdown further accelerated this trend, as investors turned to digital assets for diversification amid fiscal disruptions.

In parallel, the U.S. dollar index has declined nearly 9% year-to-date, underscoring a shift toward alternative stores of value like cryptocurrencies, gold, and silver. Every non-stablecoin in the top 20 cryptocurrencies by market cap has posted weekly increases as of October 10, 2025.

This environment spotlights opportunities beyond Bitcoin. Ethereum, BNB, and Solana emerge as key players, each leveraging unique strengths in decentralized finance (DeFi), institutional adoption, and emerging technologies.

Understanding these dynamics requires examining their recent performance and underlying drivers, which could sustain momentum even as regulatory hurdles persist.

Ethereum's Steady Climb in DeFi and Stablecoin Dominance

Ethereum's Recent Performance and Market Position

Ethereum has recorded more than 9% growth in the past week, positioning it as a resilient force in the current rally. Although it has not yet reclaimed its previous all-time high, the network's foundational role in smart contracts continues to attract substantial activity.

As the pioneer of programmable blockchain technology, Ethereum powers a vast ecosystem. Its market cap remains among the top tier, supported by consistent developer engagement and protocol upgrades that enhance scalability.

This performance comes at a time when broader market sentiment favors established platforms. Investors view Ethereum as a benchmark for innovation, with its transaction volume often mirroring overall crypto adoption trends.

The Role of Stablecoins in Ethereum's Ecosystem

Stablecoins represent a cornerstone of Ethereum's utility, with over half of the $300 billion total supply issued on its network. These assets, pegged to fiat currencies like the U.S. dollar, facilitate seamless transactions in DeFi protocols and cross-border payments.

This dominance stems from Ethereum's robust infrastructure for issuing and redeeming stablecoins. Platforms like Tether and USD Coin rely heavily on Ethereum for liquidity, ensuring low volatility within a high-growth environment.

Recent data indicates stablecoin transfers on Ethereum have surged alongside the Bitcoin rally, bolstering network fees and reinforcing its position as the go-to chain for financial applications. Such metrics highlight Ethereum's trustworthiness for institutional players seeking reliable on-ramps to crypto.

Grayscale's Staking ETFs: A Game-Changer for Yields

A landmark development occurred on October 6, 2025, when Grayscale launched the first U.S. spot Ethereum exchange-traded products (ETPs) with staking capabilities. The Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Mini Trust ETF (ETH) now allow investors to earn yields by locking assets for network validation.

Staking involves delegating Ethereum holdings to secure the blockchain, rewarding participants with additional tokens. This mechanism not only generates passive income—typically 3-5% annually—but also contributes to Ethereum's proof-of-stake consensus, which prioritizes energy efficiency over mining.

These ETPs democratize access for traditional investors, bridging regulated finance with blockchain rewards. Early indications suggest increased inflows, as staking addresses a key demand for yield in a low-interest-rate landscape.

BNB's Breakout: Outpacing Bitcoin with Institutional Tailwinds

BNB's Impressive Weekly Surge and All-Time High

BNB has distinguished itself by rising approximately 30% in the past week, eclipsing Bitcoin's gains and reaching a new all-time high above $1,300. This outperformance signals BNB's independence from broader market tides, driven by ecosystem-specific catalysts.

Originally launched as Binance Coin, BNB has matured into a versatile asset supporting multiple use cases. Its price trajectory reflects heightened utility, with trading volumes spiking amid the rally.

Evolution of BNB Smart Chain in DeFi

The BNB Smart Chain (BSC) serves as the backbone for BNB's growth, capturing 6% of total value locked (TVL) across DeFi protocols. According to DefiLlama, BSC's TVL has climbed 24% in the past month, outpacing many competitors.

This chain offers Ethereum-compatible smart contracts with lower fees and faster confirmations, appealing to developers building decentralized applications (dApps). Popular sectors include lending platforms and yield farms, where BNB acts as the native gas token.

The chain's interoperability with other blockchains further amplifies its reach, enabling cross-chain DeFi strategies.

Institutional Adoption and Regulatory Navigation

Kazakhstan's Alem Crypto Fund marked a milestone by selecting BNB as its inaugural investment on October 2025. This government-backed initiative, partnered with Binance Kazakhstan, aims to build digital asset reserves, injecting legitimacy into BNB's profile.

Despite past challenges—such as founder Changpeng Zhao's 2023 guilty plea for money laundering violations, resulting in a four-month sentence—BNB has rebounded under CEO Richard Teng's leadership. Forbes estimates Zhao retains over 60% of circulating BNB, underscoring concentrated yet influential holdings.

These developments counterbalance regulatory scrutiny, with Teng emphasizing compliance to attract institutions.

Solana's Rising Profile in Tokenization and ETF Anticipation

Solana's Weekly Gains Amid Lagging Institutional Flows

Solana has achieved 9% appreciation over the past week, capitalizing on the crypto surge despite earlier underperformance relative to Bitcoin and Ethereum. Its focus on high-throughput transactions positions it for niche dominance.

With transaction speeds exceeding 2,000 per second and fees under $0.01, Solana appeals to applications requiring real-time processing. This efficiency has sustained user growth, even as the network addresses occasional outage concerns through upgrades.

Capturing the Real-World Asset Tokenization Market

Tokenization of real-world assets (RWAs) is transforming Solana into a frontrunner for bridging traditional finance with blockchain. RWAs digitize ownership of assets like real estate, equities, and art, enabling fractional trading and liquidity.

Per RWA.xyz data, Solana ranks seventh in tokenized asset value but leads the top-10 networks with nearly 40% monthly growth. This acceleration stems from integrations with financial institutions testing blockchain for securities issuance.

Solana's architecture supports complex smart contracts for RWAs, ensuring compliance with standards like ERC-20 equivalents.

Spot ETF Prospects and Government Shutdown Impacts

Anticipation surrounds potential spot Solana ETFs, which could unlock billions in institutional capital similar to Bitcoin's approvals. However, the U.S. government shutdown introduces delays, as the Securities and Exchange Commission (SEC) operates with limited staff.

Approval timelines remain uncertain, yet filings from major asset managers signal strong interest. Solana's inclusion in ETF discussions underscores its maturation, with low fees and speed as key selling points.

If realized, these products would enhance liquidity and price stability. For now, organic growth in tokenization sustains momentum.

Broader Implications: Crypto as a Hedge in Uncertain Times

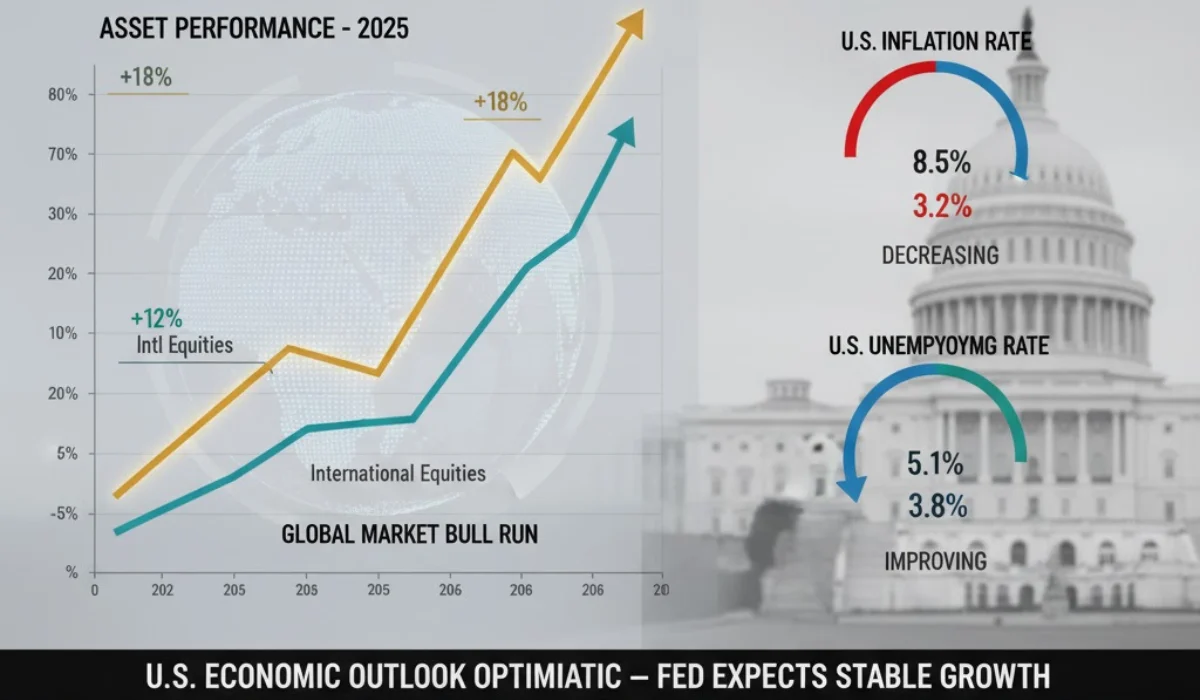

Economic Factors Fueling Crypto's Appeal

The government shutdown has amplified crypto's role as a hedge against policy volatility. With the dollar index down 9% year-to-date, investors seek uncorrelated assets to preserve capital.

Cryptocurrencies offer portability and divisibility advantages over traditional havens like gold. Institutional inflows, projected to exceed $100 billion in 2025, further validate this shift, per industry reports.

Risks and Transparency Challenges in Crypto Markets

Despite optimism, cryptocurrencies carry inherent risks. The 2022 market crash, involving exchange failures like FTX, exposed vulnerabilities in liquidity and oversight.

Transparency lags behind equities, with decentralized reporting prone to manipulation. Regulatory frameworks, while evolving, remain fragmented across jurisdictions.

Investors should allocate crypto conservatively—typically 5-10% of portfolios—to mitigate drawdowns. Diversification across assets like Ethereum, BNB, and Solana balances exposure.

Building a Long-Term Investment Thesis

Surging prices tempt impulsive trades, but disciplined strategies prevail. Define goals, such as yield generation via staking or growth through tokenization exposure, before committing capital.

Monitor metrics like TVL and on-chain activity for informed decisions. As crypto integrates with real-world finance, its viability strengthens, rewarding patient, research-driven approaches.

Conclusion: Navigating the Crypto Wave with Confidence

The Bitcoin rally of October 2025 has illuminated Ethereum, BNB, and Solana as compelling opportunities. Ethereum's staking innovations, BNB's institutional embrace, and Solana's tokenization prowess each contribute to a maturing market.

As economic headwinds persist, these assets offer hedges backed by tangible utility. Yet, prudence remains essential—crypto's high-reward potential demands risk-aware participation.

Staying informed on developments like ETFs and DeFi expansions will guide future moves. In a landscape of $4.38 trillion in value, selective focus on proven leaders ensures sustainable gains.