Navigating Economic Headwinds in October 2025

The U.S. economy faces a complex landscape as of October 2025. Inflation has ticked up, with the annual rate reaching 2.9% in August, marking the highest since January. Meanwhile, unemployment stands at 4.3% following August data, reflecting ongoing labor market pressures.

The Federal Reserve's recent 25 basis point cut in September brought the federal funds rate to a 4.00%-4.25% range, signaling further easing amid these challenges.

Adding to the uncertainty, the government shutdown, now in its second week, disrupts economic data releases and heightens market jitters. Investors grapple with sticky inflation, potential stagflation risks, and a concentrated U.S. stock market driven by technology. In this environment, turning to expert guidance becomes essential.

Professionals from renowned firms emphasize tailored strategies over reactive moves. These recommendations focus on liquidity, diversification, and inflation protection. By incorporating historical context and current yields, investors can build resilient portfolios.

Rob Williams from Charles Schwab: Building a Bond or CD Ladder

Charles Schwab, a pioneer in discount brokerage since 1971, has long advocated for accessible investing tools. Founded by Charles R. Schwab, the firm manages trillions in assets and serves millions of clients worldwide.

Rob Williams, managing director and head of wealth management research at Charles Schwab, highlights the bond or CD ladder as a prudent choice for short-term needs. Markets remain volatile, he notes, making it crucial to separate liquidity funds from long-term strategies.

Current money market funds yield around 4% or slightly higher, aligning with the federal funds rate. However, with another Fed cut anticipated later this year, these rates could dip to 3.75% or lower. CDs with two-year maturities have already seen yields drop post the initial rate reduction.

Understanding the Bond Ladder Strategy

A bond ladder involves purchasing bonds or CDs with staggered maturities, typically from short to medium term. This approach locks in current rates while providing periodic liquidity as instruments mature.

For instance, an investor might allocate funds across 1-year, 2-year, and 3-year CDs. As each matures, reinvestment occurs at prevailing rates, mitigating reinvestment risk. In today's market, where CD rates top 4.35% for terms up to five years, this strategy captures higher yields before further declines.

Williams stresses that this tactic suits horizons of three to four years. It avoids disrupting core equity or long-term bond holdings. Historically, during rate-cutting cycles like 2019-2020, ladders preserved income better than single-maturity investments.

Benefits Amid Rate Uncertainty

The fixed income market anticipates additional cuts, pushing yields lower preemptively. Traditional savings accounts face similar drops. By laddering, investors secure portions at elevated rates, such as the current 4.25% APY on eight-month CDs.

This method also offers predictability. In an era of economic flux, where unemployment claims rose to 235,000 in early October due to the shutdown, having accessible funds without market exposure proves invaluable.

Schwab's research underscores that ladders enhance portfolio stability. They generate steady income, crucial when inflation erodes purchasing power. For conservative investors, this balances yield and safety effectively.

Ken Ryan from Parnassus Investments: Embracing International Equities

Parnassus Investments, established in 1984, specializes in sustainable and responsible investing. The firm focuses on high-quality companies, managing assets with an emphasis on long-term value and environmental considerations.

Ken Ryan, portfolio manager at Parnassus, advocates for international equities to counter U.S. market concentration. The domestic economy shows stress, yet stocks climb, largely fueled by tech and AI sectors comprising 40% of the S&P 500.

Outside the U.S., opportunities abound in Europe, Asia, and Japan. These regions face different dynamics, lacking the same sector dominance. Diversification here reduces reliance on AI progress or U.S.-specific risks.

Performance Trends in Global Markets

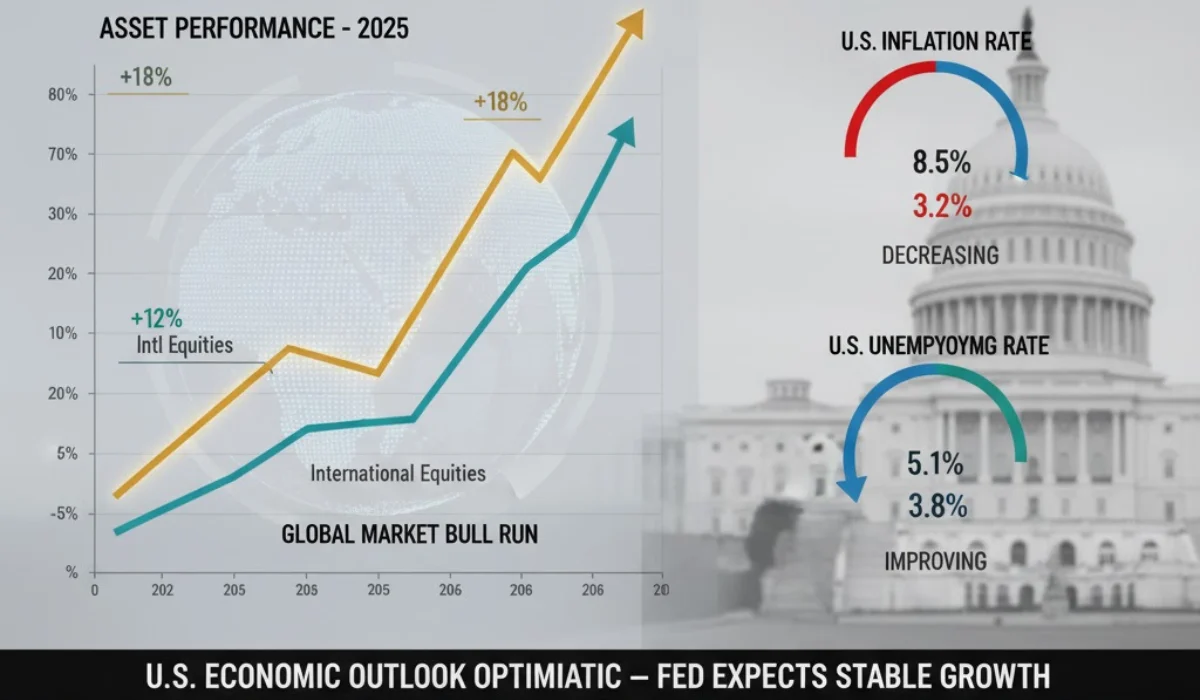

In 2025, international stocks have outperformed U.S. equities by significant margins, especially in dollar terms. European gains, amplified by a stronger euro, highlight this shift. Through mid-year, non-U.S. markets in the MSCI ACWI showed robust returns, with 75% of top performers originating abroad over the past 15 years.

Asia and Japan benefit from unique growth drivers, such as post-pandemic recovery and manufacturing rebounds. Unlike the U.S., these markets spread risk across sectors, offering balance amid domestic volatility.

Ryan points out that while U.S. investment remains vital, overlooking global options limits diversification. With the dollar weakening 10% in the first half of 2025—its worst start since 2009—international holdings gain currency advantages.

Why Now for Overseas Exposure

Current stressors, including the government shutdown and Fed actions, amplify U.S. uncertainties. International equities provide a hedge, as evidenced by Q1 2025 outperformance in Europe and China, driven by AI spillover and reconstruction prospects.

For portfolio construction, allocating 20-30% to globals aligns with expert benchmarks. ETFs tracking MSCI EAFE indices offer easy access, with low fees and broad coverage. This strategy has historically smoothed returns during U.S. downturns, like the 2008 crisis.

Parnassus's sustainable lens adds value, selecting firms with strong governance in emerging markets. As global trends like energy transitions accelerate, these equities position investors for sustained growth.

Michael Arone from State Street: Allocating to Real Assets

State Street Investment Management, part of State Street Global Advisors since 1978, manages vast institutional assets. The firm excels in index strategies and cash solutions, serving as a cornerstone for diversified portfolios.

Michael Arone, chief investment strategist at State Street, revisits the classic 60/40 stock-bond split as a foundation. However, with bonds challenged by volatile long-term rates and sticky inflation, he suggests reallocating 10% from the bond portion to real assets.

Real assets include precious metals like gold, real estate, infrastructure, natural resources, and commodities. This shift addresses inflation risks while generating income.

The Role of Real Assets in 2025

In 2025, real assets shine amid higher rates and volatility. Infrastructure and real estate sectors benefit from lower rates, supporting valuations. Data centers and sustainable housing drive demand, creating opportunities in sub-sectors like retail and energy.

Arone notes that ETFs bundle these components efficiently. A 10% allocation can yield real income, hedging against inflation expected to accelerate with tariffs and supply issues. U.S. private real estate funds project above-average returns, fueled by distressed deals and fundamentals.

Historically, real assets outperformed during inflationary periods, such as the 1970s. Today, with global shortages in housing and AI-driven energy needs, they offer tangible value.

Building Diversification with Real Assets

Shifting from bonds mitigates duration risk. As Treasury yields hover around 4.05% for 10-year notes, real assets provide uncorrelated returns. Precious metals alone have surged, with gold up 54.68% year-to-date.

Infrastructure investments, via funds, tap into essential services like utilities. Natural resources counter commodity price swings. This blend enhances portfolio resilience, especially with stagflation looming.

State Street's expertise in asset management ensures scalable options. Investors can self-build or opt for all-in-one ETFs, simplifying exposure in a complex market.

Chris Brown from T. Rowe Price: Favoring Treasurys in Fixed Income

T. Rowe Price, founded in 1937 by Thomas Rowe Price Jr., pioneered growth stock investing. The firm manages over $1 trillion, emphasizing research-driven strategies for long-term success.

Chris Brown, head of securitized products and fixed income portfolio manager at T. Rowe Price, views fixed income as broadly attractive. Despite a recent Treasury rally, yields remain elevated, drawing strong demand.

Corporate credit offers appealing all-in yields, though spreads are tight. Treasurys stand out, with potential for higher yields due to fiscal policies and persistent inflation.

Current Treasury Market Dynamics

As of October 10, 2025, 10-year Treasury yields sit at 4.05%, down slightly but still robust. The 2-year note yields 3.53%, reflecting curve expectations. Demand persists, supported by loose financial conditions reminiscent of early 2022 pre-hike levels.

Brown warns of inflation's incomplete defeat, with tailwinds from growth and policy. If yields rise gradually, fixed income demand holds; sharp drops could erode appeal.

In this context, Treasurys serve as a safe haven. Their liquidity and government backing make them ideal amid shutdown disruptions. Historical data shows Treasurys rallying during uncertainty, preserving capital.

Strategic Allocation to Treasurys

T. Rowe Price recommends Treasurys for the bond sleeve, balancing yield and safety. With the Fed's accommodative stance, short-to-intermediate terms capture upside if rates climb.

Credit sectors complement, but Treasurys anchor portfolios. Investors benefit from current 4.63% 30-year yields, locking in before potential shifts. This approach aligns with the firm's growth philosophy, blending income with capital appreciation potential.

James Cordier from Alternative Options: Betting on Gold

Alternative Options, led by CEO James Cordier, specializes in options trading and alternative strategies. The firm focuses on commodities and hedges for sophisticated investors.

James Cordier, CEO of Alternative Options, predicts continued upward pressure on gold in 2025. The metal has seen historic gains, fueled by stagflation signals: weak job data alongside sticky inflation.

This scenario boxes the Fed, complicating policy. Coupled with U.S. debt burdens and global central bank demand, gold's appeal intensifies.

Gold's 2025 Trajectory and Stagflation Risks

Gold prices reached $4,098 per ounce on October 13, 2025, up 2.11% daily and 54.68% yearly. Forecasts eye $3,675 average by Q4, potentially hitting $4,000 by mid-2026.

Stagflation risks escalate, with Powell warning of no easy avoidance. Recent data shows sluggish growth and elevated prices, exacerbated by tariffs and shutdowns. Economists attribute this to policy uncertainties, with global GDP slowing.

Gold thrives in such environments, as seen in the 1970s. Central banks' insatiable buying and dollar debasement propel prices. Projections suggest $10,000 per ounce by 2028 if trends persist.

Incorporating Gold into Portfolios

Cordier advises gold as an inflation hedge, allocating 5-10% via ETFs or physical holdings. Its low correlation to stocks enhances diversification. In 2025's volatile climate, gold counters equity risks.

Alternative Options' expertise in options allows leveraged plays, but direct exposure suffices for most. As stagflation looms in states like California and Florida, gold safeguards wealth.

Conclusion: Crafting a Resilient Investment Plan

These expert insights underscore diversification's importance. From ladders to gold, strategies address 2025's unique pressures. By blending them, investors can weather inflation, rate shifts, and shutdown effects.

Consult professionals for personalized advice, as markets evolve rapidly.