Understanding Social Security Basics in 2025

The Social Security program remains a cornerstone of retirement security for millions of Americans. Established in 1935 under the Social Security Act, it provides benefits to retirees, disabled workers, and survivors based on lifetime earnings.

In 2025, the program faces heightened scrutiny due to demographic pressures and fiscal projections. The Old-Age and Survivors Insurance (OASI) trust fund supports retirement benefits, while the Disability Insurance (DI) fund covers disability claims. Combined, these funds hold $2.72 trillion in reserves as of late 2024.

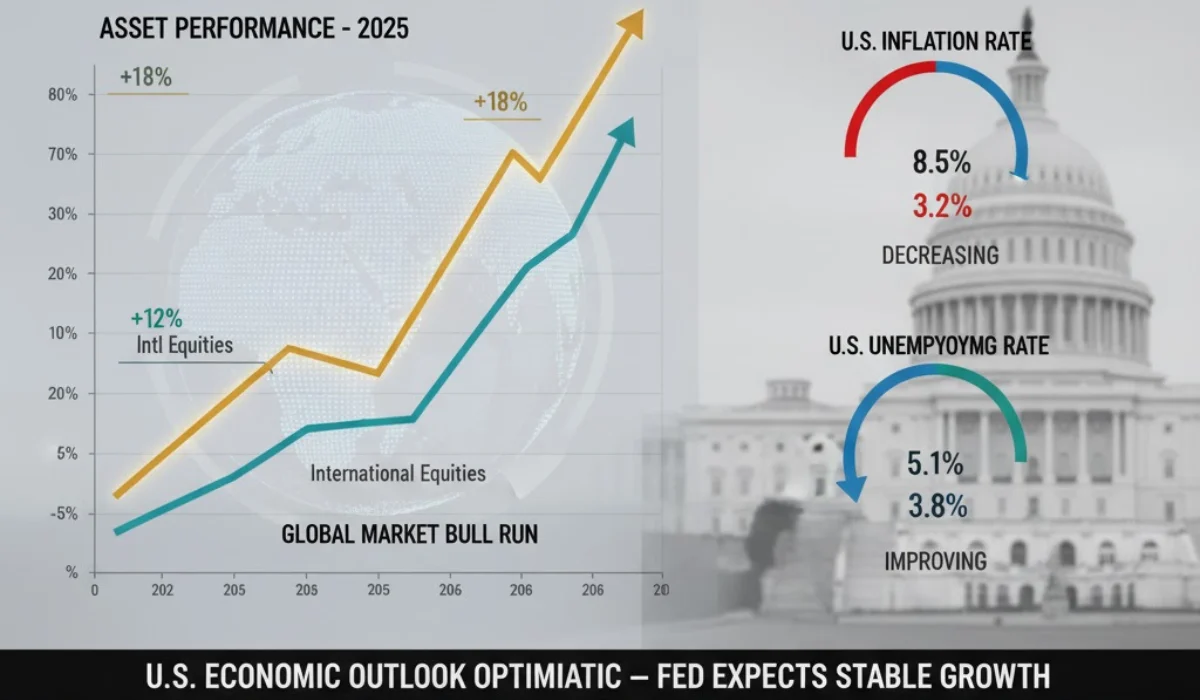

Annual cost-of-living adjustments (COLAs) help maintain purchasing power. For 2025, the COLA stands at 2.5%, the smallest since 2021, reflecting moderated inflation after peaks in 2022. This adjustment boosts average retirement benefits by about $50 monthly, reaching $1,976 overall.

Eligibility requires 40 credits, typically earned through 10 years of work. Benefits derive from the Primary Insurance Amount (PIA), calculated from the highest 35 years of indexed earnings. Claiming age profoundly influences final payouts, with reductions for early claims and credits for delays.

Full Retirement Age: The Foundation of Benefit Calculations

Full Retirement Age (FRA) marks the point for unreduced benefits. It varies by birth year, a change enacted in 1983 to address longevity gains.

For those born 1943-1954, FRA is 66. It rises gradually: 66 and 2 months for 1955 births, up to 66 and 10 months for 1959. Individuals born 1960 or later reach FRA at 67.

This adjustment accounts for increased life expectancies. In 1935, average life expectancy hovered around 61; by 2025, it stands at 78.4 years at birth, per CDC data.

Reaching FRA ensures the PIA reflects full career contributions. The taxable maximum for 2025 is $176,100, up from $168,600 in 2024. Earnings above this cap do not boost benefits.

Understanding FRA guides claiming decisions. Those nearing eligibility in 2025, especially baby boomers born post-1959, must align strategies with these thresholds.

Historical Evolution of FRA

The original FRA of 65 aligned with 1930s demographics. Post-World War II prosperity and medical advances extended lifespans, prompting reforms.

The 1983 Amendments gradually phased in increases to sustain solvency. By 2025, the shift to 67 for younger cohorts underscores ongoing adaptations to workforce trends.

Projections indicate further pressures. With fewer workers per retiree—down from 5:1 in 1960 to 2.8:1 today—policymakers debate additional tweaks.

Benefit Reductions for Early Claiming

Claiming before FRA incurs permanent reductions. Starting at age 62, the earliest eligibility, benefits drop for each premature month.

The formula applies 5/9 of 1% reduction per month for the first 36 months below FRA. Beyond that, it's 5/12 of 1% per month. For FRA 67, age 62 claiming yields about 70% of PIA—a 30% cut.

This structure discourages early draws on reserves. In 2025, with COLA applied, an average FRA benefit of $1,976 shrinks to roughly $1,383 at 62.

Reductions apply to retired-worker benefits but not entirely to spousal or survivor claims. Early claiming locks in lower bases, though annual COLAs provide modest uplift.

Impact on Low-Income Retirees

Early claimants often cite health or financial needs. Data shows 30% of beneficiaries start at 62, per SSA statistics.

For those with limited savings, this provides immediate relief. However, it amplifies reliance on programs like SSI, which also receive the 2.5% COLA in 2025.

Economists note early claiming correlates with lower lifetime earnings. Women, averaging fewer high-earning years due to career gaps, face steeper relative reductions.

Rewards for Delaying Past FRA

Delaying beyond FRA earns Delayed Retirement Credits (DRCs). Each month adds 2/3 of 1% to the benefit, equating to 8% annually until age 70.

For FRA 67, waiting to 70 boosts benefits by 24%. The 2025 maximum at 70 reaches $5,108 monthly, versus $2,831 at 62.

DRCs cease at 70; no further growth occurs. This cap incentivizes claims by then, maximizing monthly income for longer lifespans.

Only 10% of claimants reach 70, per recent surveys. Barriers include health uncertainties and spousal coordination needs.

Tax Implications of Delayed Benefits

Higher delayed benefits may push more income into taxable brackets. Up to 85% of Social Security can be taxed for higher earners.

In 2025, provisional income thresholds remain unchanged: $25,000-$34,000 for singles, $32,000-$44,000 for joint filers. Delayers should model Roth conversions to mitigate future taxes.

Average Monthly Benefits by Claiming Age in 2025

SSA data from December 2024, post-COLA, reveals stark differences. Age 62 recipients average $1,346 monthly, reflecting widespread early claims.

At 65, the figure rises to $1,615, blending some FRA achievers with delayers. Age 70 claimants top the list at $2,152, embodying the delay premium.

Overall, retired workers average $1,976. These vary by gender and region; men often see higher amounts due to earnings histories.

Maximums underscore potential: $4,018 at FRA, $5,108 at 70. Achieving these demands 35 years at the taxable cap.

Regional Variations in Averages

Benefits skew higher in high-wage states like Connecticut ($1,900+ average) versus Mississippi ($1,600). Urban areas benefit from elevated earnings records.

Rural claimants, facing lower costs but fixed health expenses, may prioritize early access. 2025 data highlights a 5-10% interstate spread.

Lifetime Benefit Projections and Life Expectancy

Lifetime totals hinge on claiming age and longevity. Assuming 85-year expectancy, a 62-year-old collects $386,640 over 23 years at $1,346 monthly.

A 65-year-old, over 20 years, totals $386,400. The 70-year-old, spanning 15 years at $2,152, reaches $386,880—nearly identical breakeven.

Shorter spans favor early claims. At 75 expectancy, age 62 yields $209,352; age 70 just $128,880.

US life expectancy at 65 is 19.5 years in 2025, per CDC—84.5 overall. Retirees often plan for 90+ to buffer uncertainties.

Factors Influencing Life Expectancy

Advancements in cardiology and oncology extend retiree years. However, disparities persist: non-whites average 3-5 years less.

Lifestyle metrics—exercise, diet—add 5-7 years, per studies. Planners use SSA's calculator for personalized estimates.

Strategies to Maximize Social Security in 2025

Optimization starts with earnings. Aim for 35 high years; part-time work post-62 can replace low earners.

Delay if feasible. The 8% annual DRC outpaces most investments. Bridge with 401(k)s or pensions.

Coordinate spousal claims. The higher earner delays; lower claims at 62 for dual income. Survivor benefits reach 100% of deceased's amount.

Working While Claiming: Earnings Tests

Pre-FRA earnings above $23,400 in 2025 trigger $1 withheld per $2 excess. Post-FRA, the limit jumps to $62,160, with $1 per $3.

Withheld amounts repay via higher future benefits. This encourages phased retirement.

Spousal and Survivor Benefits: Family Considerations

Spousal benefits cap at 50% of partner's PIA at FRA. Early claims reduce this proportionally.

Survivors receive 100% of deceased's benefit. Delaying the primary earner maximizes this safety net.

Divorced spouses qualify after 10-year marriages, without affecting originals. Remarriage post-60 preserves eligibility.

Dual-Entitlement Rules

If eligible for both worker and spousal, SSA pays the higher. This caps total at one's own PIA.

In 2025, 40% of women rely on spousal/survivor benefits, per SSA. Gender wage gaps amplify this dynamic.

Integrating Social Security with Broader Retirement Savings

Social Security replaces 40% of pre-retirement income for average earners. Supplement with 401(k)s targeting 70-80% replacement.

Roth IRAs offer tax-free growth, ideal for delayers. Annuities mimic lifetime streams.

2025 contribution limits rise: $23,500 for 401(k)s, $7,000 for IRAs (plus catch-ups).

Tax-Efficient Withdrawal Sequences

Draw taxable accounts first, preserving Roths. QCDs reduce RMDs for charitably inclined over 70.5.

Model scenarios with SSA's Quick Calculator. Adjust for 2.5% COLA and potential policy shifts.

The 2025 COLA: Maintaining Real Value

COLA ties to the Consumer Price Index for Urban Wage Earners (CPI-W). Third-quarter 2024's 2.5% rise yields the adjustment.

Payments increase January 2025; SSI starts December 31, 2024. Notices arrive via my Social Security accounts.

Historically, COLAs averaged 2.6% over the decade. Lower 2025 hikes reflect cooling energy prices.

Beyond COLA: Inflation Realities

Healthcare inflation outpaces CPI at 4-5%. Medicare Part B premiums, deducted from benefits, rise 5.9% to $185.00 monthly.

Retirees budget 15% of income for medicals. HSAs provide tax-advantaged buffers pre-65.

Trust Fund Challenges: Implications for Future Benefits

The 2025 Trustees Report projects OASI depletion in 2033, combined funds in 2034. Post-depletion, 81% of benefits payable from revenues.

Legislation like the Social Security Fairness Act, repealing offsets, accelerated timelines by a year. Shortfall equals 3.82% of payroll over 75 years.

Reforms eyed: raise payroll cap, adjust FRA, or means-test. Bipartisan talks intensify ahead of 2033.

Demographic Drivers of Strain

Baby boomers' retirements swell rolls; fertility at 1.6 births per woman shrinks inflows. Immigration bolsters, adding 0.5% to GDP annually.

Projections assume 2.1% productivity growth. Low-wage sectors lag, widening gaps.

Policy Debates and Potential Reforms in 2025

Congress debates solvency fixes. Proposals include taxing benefits fully for high earners or lifting the cap to $400,000.

The Fairness Act boosts payouts for 2.8 million, costing $200 billion over 10 years. Offsets balance via revenue hikes.

No immediate cuts loom, but 2033 mandates action. Retirees monitor via SSA alerts.

Bipartisan Paths Forward

Raising the retirement age to 69 by 2033 closes 20% of gap. Expanding credits for caregivers aids families.

Public trust hinges on transparency. SSA's 2025 initiatives include digital upgrades for faster claims.

Health and Longevity: Personalizing Your Strategy

Health assessments guide claims. Chronic conditions shorten expectancy; delay suits the healthy.

Family history factors in. Tools like Blue Zones calculators estimate personalized spans.

Annual checkups preserve workforce participation, boosting earnings records.

Wellness Investments for Retirees

Exercise adds 3-5 years; Mediterranean diets cut risks 20%. Medicare covers preventive screens.

Mental health support via telehealth expands access, vital as isolation rises post-retirement.

Case Studies: Claiming Scenarios in 2025

Consider a 1960-born worker with FRA 67, PIA $2,000. At 62: $1,400 monthly. At 65: $1,680. At 70: $2,480.

Lifetime at 85: $403,200 early vs. $446,400 delayed. Breakeven nears 80.

A couple: Husband delays to 70 ($3,000), wife claims at 62 ($1,000 spousal). Survivor gets full $3,000.

Low-Earner Adjustments

Minimum benefit for 2025: $58.25 monthly for 11-year careers, up from $56.94. Long-term unemployed leverage SSI supplements.

Tools and Resources for 2025 Planners

SSA's my Social Security portal offers estimates. The Retirement Estimator projects at 62, FRA, 70.

AARP's calculator integrates pensions. Fidelity's Planning & Guidance Center models taxes.

Free counseling via SHIP programs aids Medicare-Social Security syncs.

Updating Your Earnings Record

Review annually via SSA. Correct errors—up to 20% of records have discrepancies.

Post-2025, AI enhancements streamline verifications.

Conclusion: Strategic Claiming for Long-Term Security

Claiming age shapes retirement viability. Early access aids immediacy; delays fortify longevity.

With 2025's 2.5% COLA and solvency horizons, proactive modeling pays. Consult advisors for tailored paths.

Social Security endures as a promise kept, adaptable to future needs.