Why Invest in Gold?

Gold has long been a favored asset for investors seeking diversification and a hedge against inflation. Its tangible nature and historical value make it appealing, especially during economic uncertainty.

However, like any investment, gold carries risks that require careful consideration. Understanding these risks—price volatility, speculation, opportunity cost, and fraud—can help investors make informed decisions and manage their portfolios effectively.

Price Risk in Gold Investments

Understanding Price Volatility

Gold prices can fluctuate significantly, especially when nearing record highs. Buying gold at peak prices increases the risk of losses if the market corrects. According to Darrell Fletcher, managing director at Bannockburn Capital Markets, “Buying high to hope for short-term higher is a tough strategy.” Investors must be cautious when entering the market during price surges.

Factors Driving Gold Prices

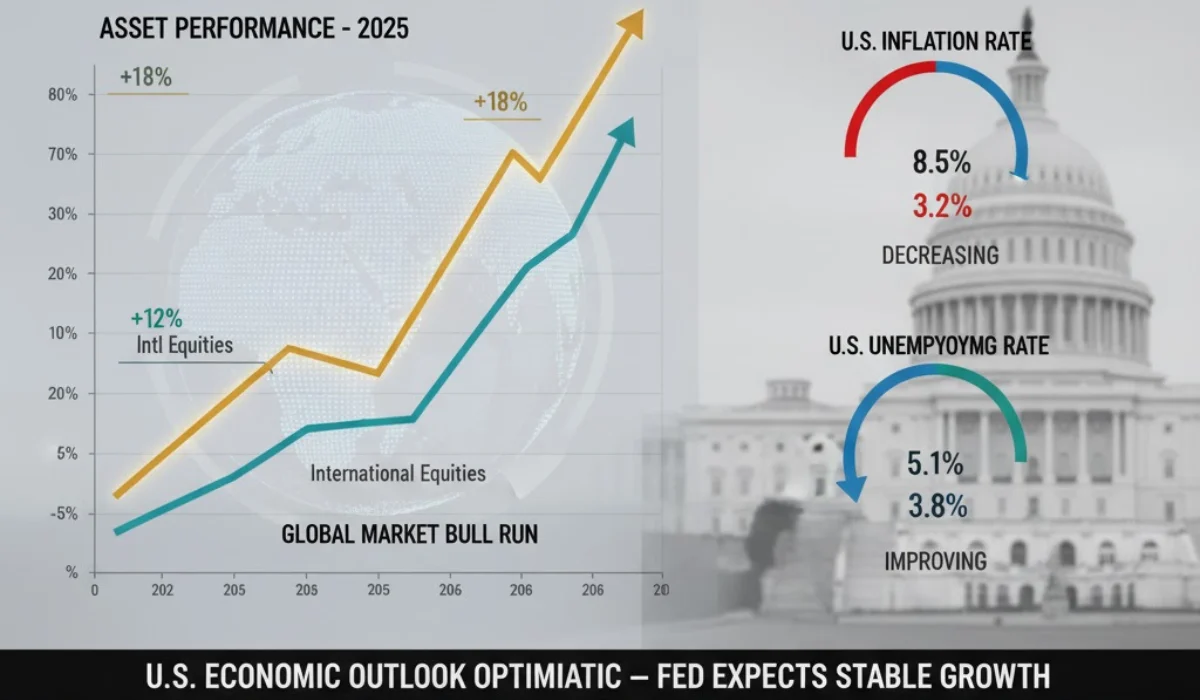

Several factors influence gold prices, including global economic conditions, interest rates, and central bank policies. For instance, central banks have increasingly turned to gold as a diversification asset, driving demand. As of October 2025, gold prices have risen 15% year-to-date, according to Yahoo Finance data, reflecting strong market interest. However, sudden shifts in these factors can lead to price drops.

Mitigating Price Risk

To reduce price risk, experts recommend maintaining realistic expectations and a long-term investment horizon. Alex Tsepaev, chief strategy officer at B2PRIME Group, advises, “Gold should not be seen as a driver of supercharged returns—it’s there to act primarily as a stabilizer in a diversified portfolio.” Allocating a small portion of your portfolio, typically 5-10%, to gold can balance risk and reward.

Speculation Risk in Gold Investments

The Nature of Speculative Investments

Gold, as a commodity, is inherently speculative. Its value depends on unpredictable factors like macroeconomic trends, geopolitical events, and market sentiment. Thomas Winmill, portfolio manager at Midas Funds, notes, “Commodity prices are dependent on macroeconomic, political, industrial, and financial factors that are unpredictable, and in some cases, unknowable.” This unpredictability can lead to significant price swings.

Managing Speculation Risk

To manage speculation risk, investors should avoid overexposure to gold. Treating gold as a small part of a diversified portfolio, rather than a primary investment, can help mitigate losses during volatile periods. Staying informed about market trends and avoiding impulsive decisions based on short-term price movements is also crucial.

Opportunity Cost Risk in Gold Investments

What Is Opportunity Cost?

Opportunity cost refers to the potential returns missed by choosing one investment over another. Gold, while a valuable diversification tool, does not generate income like stocks or bonds. Alex Tsepaev explains, “The cost of holding gold is the growth you forgo elsewhere.” This is particularly relevant when other assets, such as equities, are performing strongly.

Balancing Opportunity Cost

For example, in 2024, the S&P 500 gained approximately 20%, while gold returned 12%. Investors who allocated heavily to gold may have missed higher returns elsewhere. To minimize opportunity cost, experts suggest limiting gold to a small portion of your portfolio. This approach allows you to benefit from gold’s stability without sacrificing growth potential in other assets.

Fraud Risk in the Gold Market

Prevalence of Fraud in Gold Investments

Unlike securities, gold is not subject to strict regulations, which can expose investors to fraud. Brett Elliott, director of content and SEO at American Precious Metals Exchange (APMEX), highlights common scams, including:

-

Dealers selling low-quality or counterfeit coins and bars.

-

Sellers offering shares in nonexistent mines or fake gold-backed certificates.

-

Buyers purchasing gold jewelry at significantly undervalued prices.

Protecting Against Fraud

To avoid fraud, research dealers thoroughly before investing. Check their reputation through reviews, industry certifications, and regulatory bodies like the Better Business Bureau. Reputable dealers, such as APMEX or Kitco, provide transparency and quality assurance. Always verify the authenticity of physical gold through assays or certifications.

Benefits of Gold in a Portfolio

Despite its risks, gold offers unique benefits. It serves as a hedge against inflation, preserving purchasing power when fiat currencies weaken. Gold also provides portfolio diversification, as its price often moves independently of stocks and bonds.

During economic downturns, such as the 2008 financial crisis, gold prices rose by 5% while the S&P 500 fell 37%, showcasing its value as a safe-haven asset.

Historical Performance of Gold

Gold’s historical performance provides context for its role in portfolios. Since 2000, gold prices have risen from $280 per ounce to over $2,600 in October 2025, according to Yahoo Finance. This growth reflects gold’s long-term appeal, though short-term volatility remains a challenge. Investors should analyze historical trends to set realistic expectations.

Strategies for Safe Gold Investing

Diversify Your Portfolio

Experts recommend allocating 5-10% of your portfolio to gold to balance risk and reward. This allocation allows you to benefit from gold’s stability without overexposure to its volatility.

Choose Reputable Dealers

Work with established dealers to avoid fraud. Verify their credentials and ensure they provide certified products. For example, purchasing from dealers accredited by the Professional Numismatists Guild can enhance trust.

Consider Gold ETFs

For investors wary of physical gold, gold exchange-traded funds (ETFs) like SPDR Gold Shares (GLD) offer a convenient alternative. ETFs reduce storage and fraud risks while providing exposure to gold prices.

Monitor Market Trends

Stay informed about economic indicators, such as inflation rates and central bank policies, that influence gold prices. Tools like Yahoo Finance and Bloomberg provide real-time data to guide decisions.

Conclusion: Balancing Gold’s Risks and Rewards

Investing in gold offers diversification and inflation protection, but it comes with risks like price volatility, speculation, opportunity cost, and fraud. By understanding these risks and adopting strategies like diversification, working with reputable dealers, and staying informed, investors can navigate the gold market effectively. A balanced approach ensures gold enhances your portfolio without exposing you to undue risk.