Why Estate Planning is Essential for NRIs

Estate planning is a critical financial step for Non-Resident Indians (NRIs) living in New York. It ensures assets in both the U.S. and India are distributed according to your wishes, minimizing legal and tax complications.

For NRIs, the complexity of managing cross-border assets makes estate planning indispensable. Without a clear plan, heirs may face costly legal battles or tax burdens.

This article explores the importance of estate planning, key components, and how expert guidance from firms like Prime Wealth can simplify the process.

Managing Cross-Border Assets

NRIs often hold assets in both India and the U.S., such as real estate, bank accounts, or investments. A well-structured estate plan outlines how these assets will be distributed after your passing.

Without a plan, your heirs could face lengthy legal processes or disputes. Proper estate planning ensures a seamless transfer of wealth, reducing stress for your family.

For instance, properties in India and investments in the U.S. require careful coordination to comply with each country’s laws. A professional estate plan addresses these challenges effectively.

Navigating Cross-Border Taxation

Taxation is a significant concern for NRIs. The U.S. imposes estate taxes, while India levies capital gains taxes on inherited assets. Without proper planning, your estate could face double taxation.

Estate planning allows NRIs to minimize tax liabilities. Strategies like trusts can reduce the taxable value of your estate, preserving more wealth for your heirs.

Consulting with experts ensures compliance with both U.S. and Indian tax regulations, optimizing your estate’s financial outcome.

Protecting Your Family’s Financial Future

Estate planning goes beyond asset distribution. It safeguards your family’s financial security, ensuring they are cared for even in unforeseen circumstances.

For NRIs with young children, a plan can designate a guardian to oversee their care. For spouses, trusts can provide ongoing financial support.

This proactive approach ensures your loved ones are protected, regardless of where your assets are located.

Key Elements of NRI Estate Planning

Wills: Defining Your Legacy

A will is a foundational document that specifies how your assets should be distributed. For NRIs, a will is essential to clarify intentions across multiple jurisdictions.

Without a will, state or national laws may dictate asset distribution, which may not align with your wishes. A clear will prevents confusion and disputes.

Trusts: Simplifying Asset Transfers

Trusts offer significant advantages for NRIs. They bypass probate, the lengthy legal process of validating a will, saving time and costs.

Trusts also provide tax benefits by reducing the taxable estate value. For NRIs, trusts simplify the transfer of assets between the U.S. and India.

Revocable and irrevocable trusts can be tailored to meet specific family needs, offering flexibility and control.

Power of Attorney (POA)

A Power of Attorney (POA) designates someone to manage your financial affairs if you become incapacitated. NRIs should establish POAs in both the U.S. and India.

This ensures seamless management of assets across borders, from bank accounts to property transactions, during unexpected events.

Health Care Directives

Health care directives outline your medical treatment preferences if you’re unable to make decisions. For NRIs, these directives should align with medical practices in both the U.S. and India.

A living will, for example, ensures your healthcare wishes are respected, providing clarity for your family and medical professionals.

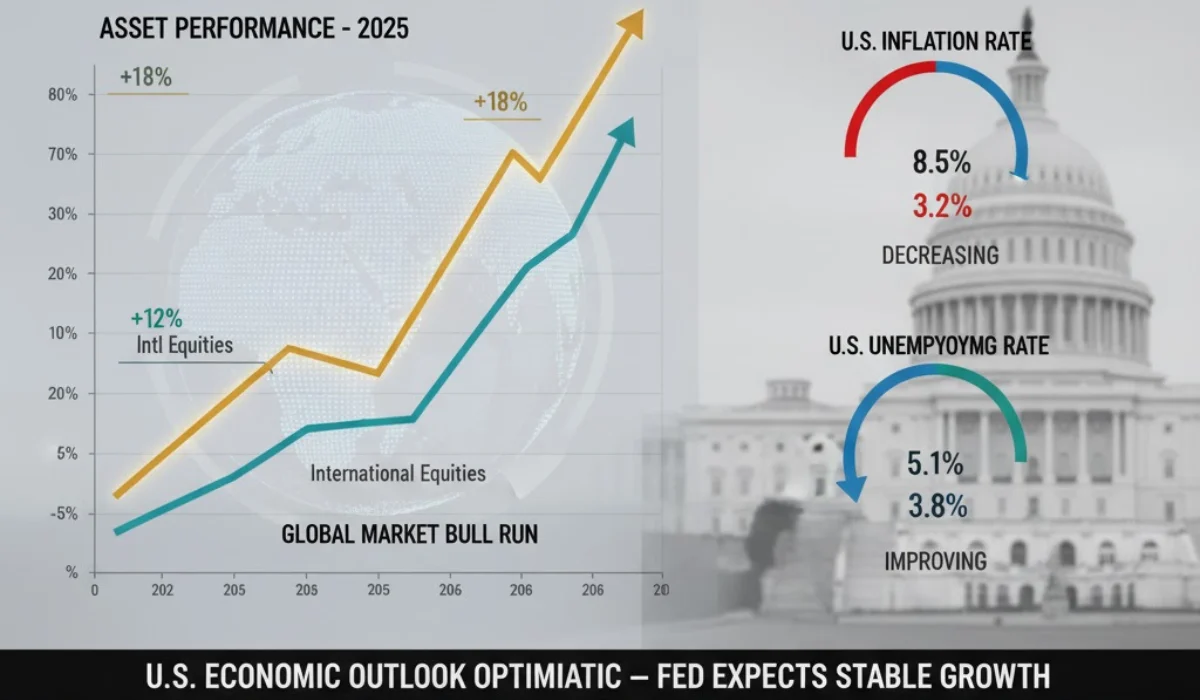

Impact of U.S. Policies on NRI Estate Planning

Recent U.S. policy changes can influence estate planning for NRIs. For instance, shifts in estate tax thresholds under certain administrations may alter the tax-free amount your estate can pass to beneficiaries.

Tax reforms could favor wealth transfers, benefiting NRIs with significant U.S. assets. However, changes in international investment policies may require adjustments to your estate plan.

Staying informed about policy updates is crucial. Expert advisors can help NRIs align their plans with current regulations to maximize benefits.

How Prime Wealth Supports NRIs

Prime Wealth specializes in guiding NRIs through the complexities of estate planning. Their expertise ensures your plan complies with both U.S. and Indian laws.

Tailored Cross-Border Solutions

Prime Wealth creates customized estate plans, addressing unique needs like cross-border asset management and tax minimization.

Their team ensures compliance with international regulations, reducing legal risks and optimizing financial outcomes.

Comprehensive Asset Protection

From drafting wills to establishing trusts, Prime Wealth safeguards your assets against legal challenges and creditor claims.

Their strategies prioritize your family’s long-term financial security, even in complex cross-border scenarios.

Expert Tax Strategies

Prime Wealth’s advisors develop tax-efficient plans, minimizing estate and capital gains taxes. This ensures more of your wealth reaches your heirs.

Their knowledge of U.S. and Indian tax systems helps NRIs navigate dual taxation challenges effectively.

Steps to Start Estate Planning

Assess Your Assets

Begin by listing all assets in the U.S. and India, including properties, investments, and bank accounts. This provides a clear picture of your estate.

Define Your Goals

Determine your priorities, such as providing for your spouse, children, or charitable causes. Clear goals guide the planning process.

Consult an Expert

Work with professionals like Prime Wealth to create a comprehensive plan. Their expertise ensures all legal and tax aspects are covered.

Review Regularly

Life changes, such as marriage or acquiring new assets, require updates to your estate plan. Regular reviews keep it relevant and effective.

Common Challenges for NRIs

Legal Differences

U.S. and Indian inheritance laws differ significantly. Without proper planning, assets may be subject to conflicting regulations, delaying distribution.

Currency and Valuation Issues

Fluctuating exchange rates and differing asset valuation methods can complicate estate planning. Expert guidance ensures accurate assessments.

Family Disputes

Unclear estate plans can lead to disputes among heirs, especially when assets span multiple countries. A well-drafted plan minimizes conflicts.

Benefits of Proactive Estate Planning

Proactive estate planning offers peace of mind. It ensures your wishes are honored, reduces tax burdens, and protects your family’s future.

For NRIs, a strategic plan simplifies cross-border complexities, making the process efficient and legally sound.

Conclusion

Estate planning is a vital step for NRIs in New York to secure their family’s financial future. By addressing cross-border assets, tax complexities, and legal requirements, a well-crafted plan ensures your wishes are honored.

With expert guidance from Prime Wealth, NRIs can navigate these challenges confidently, protecting their wealth and loved ones. Start planning today to provide lasting security for your family.

Disclaimer : This information is for educational purposes only and does not constitute financial, legal, or tax advice. Consult a qualified professional before making decisions. No liability is accepted for errors, omissions, or losses arising from this information.

FAQs

What is estate planning?

Estate planning involves preparing for the management and distribution of your assets after death or incapacitation.

Why is estate planning important for NRIs?

It helps NRIs manage cross-border assets, minimize taxes, and ensure their family’s financial security across jurisdictions.

How does Prime Wealth assist NRIs?

Prime Wealth offers tailored estate planning, including wills, trusts, and tax strategies, compliant with U.S. and Indian laws.

Is a will necessary for NRIs?

Yes, a will ensures your assets are distributed as per your wishes, especially across multiple countries.

What role do trusts play?

Trusts avoid probate, reduce taxes, and simplify cross-border asset transfers for NRIs.

How do estate taxes differ between the U.S. and India?

The U.S. imposes estate taxes, while India levies capital gains taxes on inherited assets. Planning minimizes these liabilities.

Can NRIs create a Power of Attorney?

Yes, NRIs can establish POAs in both the U.S. and India to manage financial affairs during incapacitation.

What is a living will?

A living will outlines your healthcare preferences if you’re unable to make decisions.

How can NRIs minimize tax liabilities?

Strategic planning with experts like Prime Wealth ensures tax-efficient asset management.

Can estate planning protect assets from creditors?

Yes, proper strategies can shield assets from creditors and legal challenges.